In today’s digital age, the way we conduct financial transactions has undergone a significant transformation. With the advent of credit payment processing, businesses and consumers alike have experienced unprecedented convenience and efficiency in managing payments. This article delves into the intricacies of credit payment processing, exploring its importance, types, working mechanisms, key players, advantages, challenges, trends, security measures, regulations, and the future landscape.

Introduction to Credit Payment Processing

Credit payment processing refers to the method by which businesses accept and manage payments made via credit cards or other electronic means. It enables customers to make purchases conveniently without the need for physical currency. From traditional brick-and-mortar stores to e-commerce websites, credit payment processing has become ubiquitous in modern commerce.

Importance of Credit Payment Processing

The importance of credit payment processing cannot be overstated in today’s business landscape. It offers numerous benefits to both merchants and consumers, including enhanced convenience, expanded customer base, improved cash flow, and increased sales volume. Furthermore, it fosters trust and credibility, as customers perceive businesses that accept credit cards as more reputable and reliable.

Types of Credit Payment Processing

Traditional Credit Card Processing

Traditionally, credit card processing involved physical terminals where customers swipe or insert their cards to initiate transactions. These terminals communicate with payment processors and banks to authorize and complete the transactions.

Online Payment Gateways

Online payment gateways facilitate transactions over the internet, allowing businesses to accept payments through their websites or mobile apps. These gateways encrypt sensitive information to ensure secure transmission and enable seamless integration with e-commerce platforms.

Mobile Payment Solutions

Mobile payment solutions enable customers to make payments using their smartphones or other mobile devices. From contactless payments to mobile wallets, these solutions offer unparalleled convenience and accessibility, especially in retail environments.

How Credit Payment Processing Works

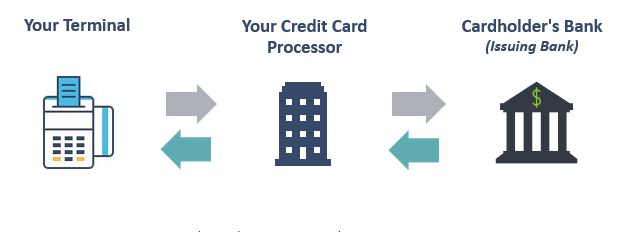

Credit payment processing involves several steps, including authorization, authentication, settlement, and funding. When a customer initiates a transaction, the merchant’s payment terminal or online gateway communicates with the card issuer to verify the card details and authorize the transaction. Once approved, the funds are transferred from the customer’s account to the merchant’s account, typically within a few days.

Key Players in Credit Payment Processing

The credit payment processing ecosystem comprises various stakeholders, including payment processors, acquiring banks, issuing banks, card networks, and merchants. Payment processors facilitate transactions between merchants and banks, while acquiring banks maintain merchant accounts and process transactions on their behalf. Issuing banks issue credit cards to consumers, and card networks, such as Visa and Mastercard, facilitate the flow of funds between banks and merchants.

Advantages of Credit Payment Processing

Credit payment processing offers numerous advantages to businesses, including increased sales, reduced cash handling costs, improved cash flow management, enhanced customer satisfaction, and access to valuable transaction data for analytics and marketing purposes. For consumers, it provides convenience, security, and rewards such as cashback and loyalty points.

Challenges in Credit Payment Processing

Despite its many benefits, credit payment processing also poses challenges for businesses, including transaction fees, chargebacks, fraud, compliance requirements, and technological complexities. Moreover, the rapid pace of innovation and changing consumer preferences necessitate continuous adaptation and investment in new technologies and security measures.

Trends in Credit Payment Processing

The credit payment processing industry is constantly evolving, driven by technological advancements, changing regulatory landscapes, and shifting consumer behaviors. Some notable trends include the rise of contactless payments, the emergence of blockchain-based solutions, the integration of artificial intelligence and machine learning for fraud detection, and the growing importance of data privacy and security.

Security Measures in Credit Payment Processing

Security is paramount in credit payment processing to protect sensitive customer information and prevent fraud. Various security measures, such as encryption, tokenization, biometric authentication, and PCI DSS compliance, are employed to safeguard transactions and mitigate risks.

Regulations and Compliance

The credit payment processing industry is subject to a myriad of regulations and compliance requirements, aimed at ensuring transparency, fairness, and consumer protection. Key regulations include the Payment Card Industry Data Security Standard (PCI DSS), the Electronic Fund Transfer Act (EFTA), and the European Union’s General Data Protection Regulation (GDPR).

Future of Credit Payment Processing

The future of credit payment processing is characterized by continued innovation and disruption, driven by advancements in technology, changing consumer expectations, and regulatory developments. Emerging trends such as tokenization, instant payments, decentralized finance (DeFi), and digital currencies are poised to reshape the industry landscape in the years to come.

Tips for Choosing a Credit Payment Processor

When selecting a credit payment processor, businesses should consider factors such as transaction fees, contract terms, integration options, security features, customer support, and scalability. It’s essential to choose a reliable and reputable processor that meets the specific needs and requirements of your business.

Case Studies: Successful Implementations

Several businesses have successfully implemented credit payment processing solutions to streamline their operations and enhance customer experiences. Case studies provide valuable insights into real-world applications and best practices for leveraging credit payment processing effectively.

Conclusion

Credit payment processing has revolutionized the way businesses and consumers transact, offering unprecedented convenience, security, and efficiency. As technology continues to advance and consumer preferences evolve, the credit payment processing landscape will undoubtedly undergo further transformation. By staying abreast of emerging trends, embracing innovation, and prioritizing security and compliance, businesses can harness the full potential of credit payment processing to drive growth and success in the digital economy.