In today’s digital age, credit card payment processing has become an essential aspect of conducting business. From retail stores to e-commerce websites, businesses rely on seamless payment transactions to serve their customers efficiently. This article delves into the intricacies of credit card payment processing, its importance, workings, types, benefits, challenges, tips for effective implementation, and future trends.

Introduction to Credit Card Payment Processing

What is credit card payment processing?

Credit card payment processing refers to the mechanism through which businesses accept and process payments made by customers using credit cards. It involves various steps and parties collaborating to authorize, capture, and settle transactions securely.

Importance in modern business

In the digital era, where cash transactions are declining, credit card payment processing plays a crucial role in facilitating commerce. It enables businesses to offer convenient payment options to customers, thereby enhancing customer satisfaction and driving sales.

How Credit Card Payment Processing Works

Steps involved in processing a credit card payment

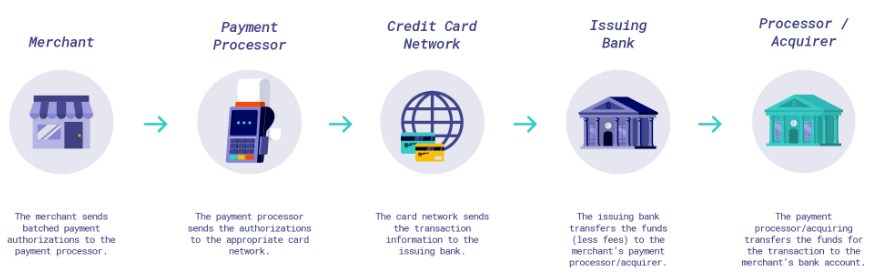

Credit card payment processing typically involves four main steps:

- Authorization: The merchant sends the transaction details to the acquiring bank for approval.

- Authentication: The acquiring bank forwards the request to the card network, which verifies the transaction with the issuing bank.

- Authorization: Upon approval, the issuing bank authorizes the transaction, and the funds are reserved.

- Settlement: At the end of the day, the funds are transferred from the issuing bank to the merchant’s account.

Role of various parties in the process

- Merchant: The entity accepting credit card payments.

- Acquiring bank: The bank that processes credit card transactions on behalf of the merchant.

- Issuing bank: The bank that issues credit cards to customers.

- Card networks: Organizations like Visa, Mastercard, and American Express that facilitate transactions between merchants and issuing banks.

Types of Credit Card Payment Processing

Traditional terminals

Traditional terminals are physical devices used by merchants to swipe or insert credit cards for payment. These terminals connect to the acquiring bank’s network to process transactions.

Online payment gateways

Online payment gateways enable businesses to accept credit card payments securely over the internet. Customers enter their card details on a website, and the payment gateway encrypts and processes the transaction.

Mobile payment processing

Mobile payment processing allows customers to make payments using their smartphones or tablets. This method utilizes mobile apps or contactless technology to facilitate transactions.

Benefits of Credit Card Payment Processing

Convenience for customers

Credit card payment processing offers convenience to customers by allowing them to make purchases without carrying cash. It also enables online shopping and contactless payments, enhancing the overall shopping experience.

Increased sales for businesses

Accepting credit card payments can lead to increased sales for businesses, as it expands their customer base and encourages impulse purchases. Moreover, offering multiple payment options can attract more customers and boost revenue.

Security features

Credit card payment processing systems employ advanced security measures, such as encryption and tokenization, to protect sensitive cardholder data. This helps prevent fraud and ensures the safety of transactions.

Challenges in Credit Card Payment Processing

Fraudulent transactions

One of the major challenges in credit card payment processing is the risk of fraudulent transactions. Fraudsters may use stolen card information to make unauthorized purchases, resulting in financial losses for businesses.

Chargebacks

Chargebacks occur when customers dispute transactions with their issuing banks, leading to funds being reversed from the merchant’s account. Excessive chargebacks can harm a merchant’s reputation and financial stability.

Compliance with regulations

Businesses must comply with various regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), to ensure the security of credit card transactions. Non-compliance can result in penalties and reputational damage.

Tips for Effective Credit Card Payment Processing

Choose the right payment processor

Select a reliable payment processor that offers competitive rates, advanced security features, and excellent customer support. Consider factors such as transaction fees, integration options, and compatibility with your business model.

Implement security measures

Protect sensitive cardholder data by implementing security measures like encryption, tokenization, and PCI DSS compliance. Regularly update your systems and educate your staff about cybersecurity best practices.

Provide clear payment options to customers

Offer a variety of payment options to cater to different customer preferences. Display accepted payment methods prominently on your website and at your physical store to ensure a seamless checkout experience.

Future Trends in Credit Card Payment Processing

Contactless payments

The popularity of contactless payments is expected to rise, driven by factors such as convenience, speed, and hygiene. Contactless technology allows customers to make transactions quickly and securely using their smartphones or contactless cards.

Integration with digital wallets

Digital wallets like Apple Pay, Google Pay, and Samsung Pay are gaining traction among consumers, offering a convenient and secure way to make payments. Integrating digital wallets with credit card payment processing systems can streamline transactions and enhance user experience.

Blockchain technology

Blockchain technology has the potential to revolutionize credit card payment processing by offering enhanced security, transparency, and efficiency. Blockchain-based solutions can reduce fraud, eliminate intermediaries, and facilitate instant settlement of transactions.

Conclusion

Credit card payment processing is an integral part of modern commerce, enabling businesses to accept payments conveniently and securely. By understanding the workings, types, benefits, challenges, and future trends of credit card payment processing, businesses can optimize their payment systems to enhance customer satisfaction and drive sales.