In today’s fast-paced business environment, accepting credit card payments is not just a convenience but a necessity. CC Merchant Services play a pivotal role in facilitating secure and seamless transactions for businesses of all sizes. From traditional retail stores to online e-commerce platforms, the demand for reliable merchant services continues to grow.

Introduction to CC Merchant Services

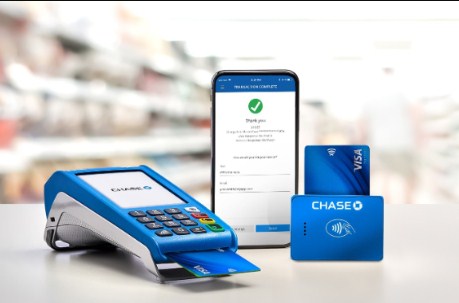

CC Merchant Services encompass a range of financial services and technologies that enable businesses to accept credit and debit card payments from customers. These services include credit card processing, payment gateways, and mobile payment solutions. By leveraging these tools, businesses can expand their customer base, improve cash flow, and enhance overall efficiency.

Importance of Merchant Services for Businesses

In a world where cash transactions are declining, offering multiple payment options is essential for staying competitive. Merchant services provide businesses with the flexibility to accept various forms of payment, including credit cards, thereby catering to the preferences of modern consumers. Moreover, by embracing electronic payments, businesses can streamline their operations and reduce the risks associated with handling cash.

Understanding Credit Card Processing

Credit card processing involves several steps, including authorization, authentication, and settlement. When a customer swipes or inserts their card to make a purchase, the transaction details are encrypted and transmitted to the merchant’s payment processor. The processor then communicates with the card issuer to verify the cardholder’s identity and approve the transaction. Once approved, the funds are transferred to the merchant’s account within a few business days.

Types of CC Merchant Services

Traditional Merchant Accounts

Traditional merchant accounts are offered by banks and financial institutions and allow businesses to accept credit card payments in-store and online. These accounts typically involve a contract with fees based on transaction volume and processing equipment.

Payment Gateways

Payment gateways are online platforms that facilitate transactions between merchants and customers. They encrypt sensitive payment information and securely transmit it between the merchant’s website and the card issuer for authorization.

Mobile Payment Processing

Mobile payment processing enables businesses to accept credit card payments using smartphones or tablets. This convenient solution is ideal for businesses that operate on-the-go, such as food trucks, vendors at events, and service providers.

Benefits of CC Merchant Services

Increased Sales Opportunities

By accepting credit card payments, businesses can attract more customers and generate higher sales volumes. Many consumers prefer to pay with credit cards due to the convenience and rewards offered by their card issuers.

Convenience for Customers

Credit card payments offer unparalleled convenience for customers, allowing them to make purchases without carrying cash or writing checks. This convenience encourages impulse purchases and repeat business.

Enhanced Security

Merchant services employ advanced security measures, such as encryption and tokenization, to protect sensitive payment information from fraudsters. Additionally, businesses can implement fraud detection tools to identify and prevent unauthorized transactions.

How to Choose the Right CC Merchant Service Provider

Selecting the right merchant service provider is critical for the success of your business. Consider factors such as transaction fees, contract terms, customer support, and compatibility with your existing systems when evaluating potential providers.

Steps to Set Up CC Merchant Services

Researching Providers

Take the time to research and compare multiple merchant service providers to find the best fit for your business needs and budget.

Application Process

Once you’ve selected a provider, complete the application process, providing accurate information about your business and financial history.

Integration with Business Systems

Integrate your chosen merchant services with your point-of-sale system or e-commerce platform to ensure smooth and efficient payment processing.

Common Challenges with CC Merchant Services

Fees and Charges

Be aware of the various fees associated with merchant services, including transaction fees, interchange fees, and monthly service fees. Negotiate with your provider to minimize these costs and maximize your profits.

Chargebacks

Chargebacks occur when a customer disputes a credit card transaction, resulting in the reversal of funds to their account. Implement strategies to reduce chargebacks, such as providing clear refund policies and promptly addressing customer concerns.

Technical Issues

Technical glitches can disrupt payment processing and impact your business operations. Stay proactive by monitoring your systems for potential issues and addressing them promptly to minimize downtime.

Tips for Maximizing the Value of CC Merchant Services

Negotiating Rates

Don’t be afraid to negotiate with your merchant service provider to secure lower transaction rates and fees. Many providers are willing to work with businesses to customize pricing packages based on their needs.

Implementing Fraud Prevention Measures

Invest in fraud detection tools and security features to protect your business and customers from unauthorized transactions and data breaches.

Providing Excellent Customer Service

Deliver exceptional customer service at every touchpoint to build trust and loyalty with your customers. Address their concerns promptly and courteously to ensure a positive shopping experience.

Case Studies: Successful Implementation of CC Merchant Services

Explore real-world examples of businesses that have successfully implemented CC merchant services to drive growth and improve customer satisfaction.

Future Trends in CC Merchant Services

As technology continues to evolve, so too will the landscape of CC merchant services. Keep an eye on emerging trends, such as contactless payments, biometric authentication, and blockchain technology, to stay ahead of the curve.

Conclusion

In conclusion, CC Merchant Services play a vital role in the success of modern businesses by enabling secure and convenient payment processing. By embracing these services and staying informed about industry trends and best practices, businesses can unlock new opportunities for growth and innovation.